Smart Agricultural Insurance System

Reassign Resources to Fulfill Everyone’s Needs

Natural disasters occur frequently in Taiwan, but the coverage of agricultural insurance is less than 6%. The fact that farmers have to shoulder most of the risks by themselves leads to unstable prices of agricultural products; however, the government is not capable of helping everyone within the limited budget.

9.7

Average occurrences of major natural disasters annually

250%

Average government supplementary budget

US$ 420mn

Annual crop losses

= 5.5% of the gross value of agricultural output

US$ 315mn

Annual crop losses that farmers pay out-of-pocket = 75% of total crop losses

To save the lose-lose situation, we aim to design a self-sustainable central agricultural insurance system to make things simpler, more efficient, and more effective – not only to improve the insurance coverage and aid processes, but also to guarantee the rights that every farmer deserves.

The Farmers Would Prefer…

A reliable but affordable insurance program to cover their crop losses for the frequent natural disasters

The Government Would Prefer…

A stable economy and a predictable budget, without endless follow-ups of emergency aids

The situation is not looking bright at the moment. Insurance companies run agricultural insurance programs that don’t break-even, while the government tries to aid all farmers who are not able to afford them annually, making the whole budget unpredictable.

Given the current imbalance, let’s see what happened to Mr. Chang, a wax apple farmer living in Taiwan.

A New System with The Resources At Hand (but use them smarter!)

To balance the government’s budgets and farmers’ needs, we take advantage of AI and IoT to calculate the total insurance premium for the governmental break-even point, as well as the progressive income insurance premium each farmer should pay, so that the insurance system is self-sustainable, and the government only needs to subsidize extra premiums for low-income farmers.

In addition, we make use of an AIoT-based Natural Disaster Prevention System as well as the Participative Farmer Assessment Program to reduce overall crop loss and optimize the insurance underwriting process.

With the system above, we hope to not only keep farmers from burdening losses on their own, but from suffering from losses at the beginning.

AI-based Smart Insurance System

Customized Policies for Everyone

Using regional, climate, crop, personal harvest, and real-time IoT data, we calculate the possibility for national disasters in the following year and total resulting losses to get the basic insurance premium for each farmer. Then we calculate the progressive income rate and the additional premium each farmer should pay, while the government subsidizes the remaining costs.

Create a break-even insurance system with an efficiently planned governmental budget and affordable premiums for the farmers.

Semi-compulsory Insurance

Universal Coverage with User Charges

Gradually remove subsidies from insurance claims and governmental purchases, encouraging farmers to join the governmental agricultural insurance program and raise coverage. Insured farmers pay premiums, and when they get losses from natural disasters, they have insurance claims and an guaranteed purchase price, while the non-insured farmers get neither.

Turn governmental crop loss aid into user charges through agricultural insurance in order to reach a high coverage without new budget.

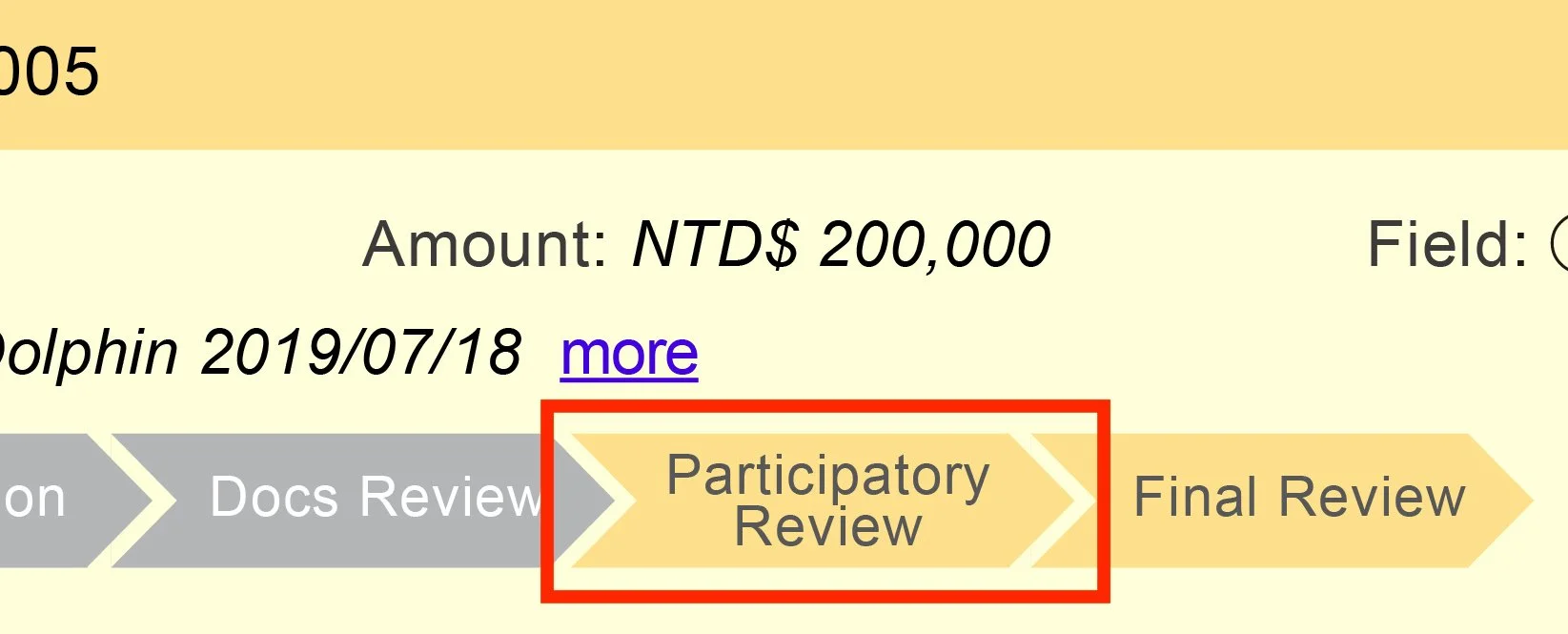

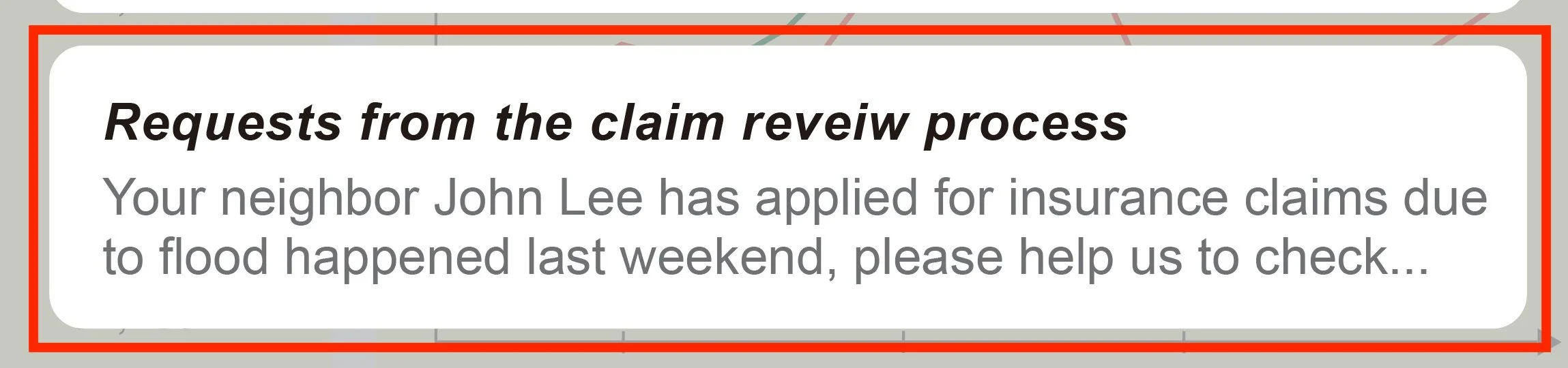

Participative Farmer Assessment Program

Simplified Process, Reduced Expense

Farmers participate in each other’s assessment of losses from natural disasters while the government conducts random inspections.

Simplify and make the claims process transparent at a low price.

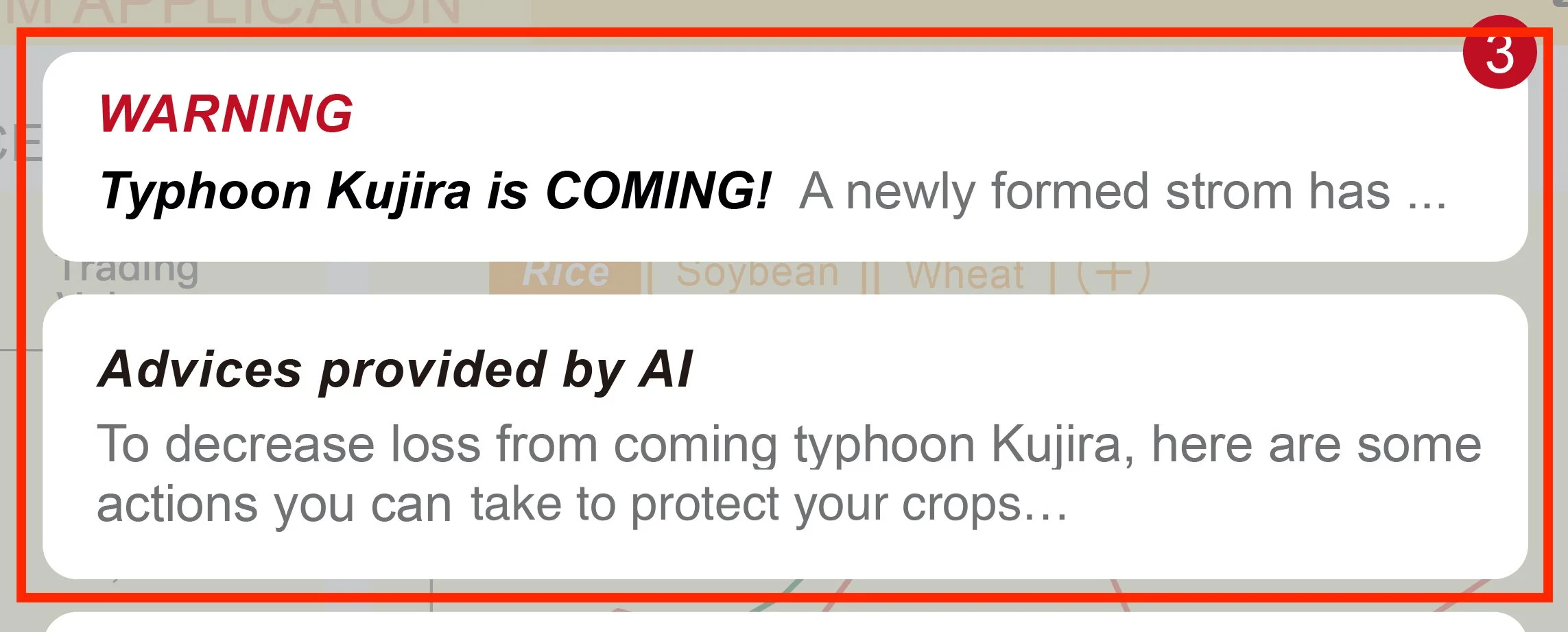

Trust System

Crop Loss reduction

With real-time IoT information, the AI system makes predictions on natural disasters and gives farmers professional advice in advance. If the farmers implement the advice yet still suffer losses, they can get a higher amount of compensation, but if the advice is not implemented, the compensation will be reduced.

Support individual farmers and reduce total agricultural losses with the centralized system.

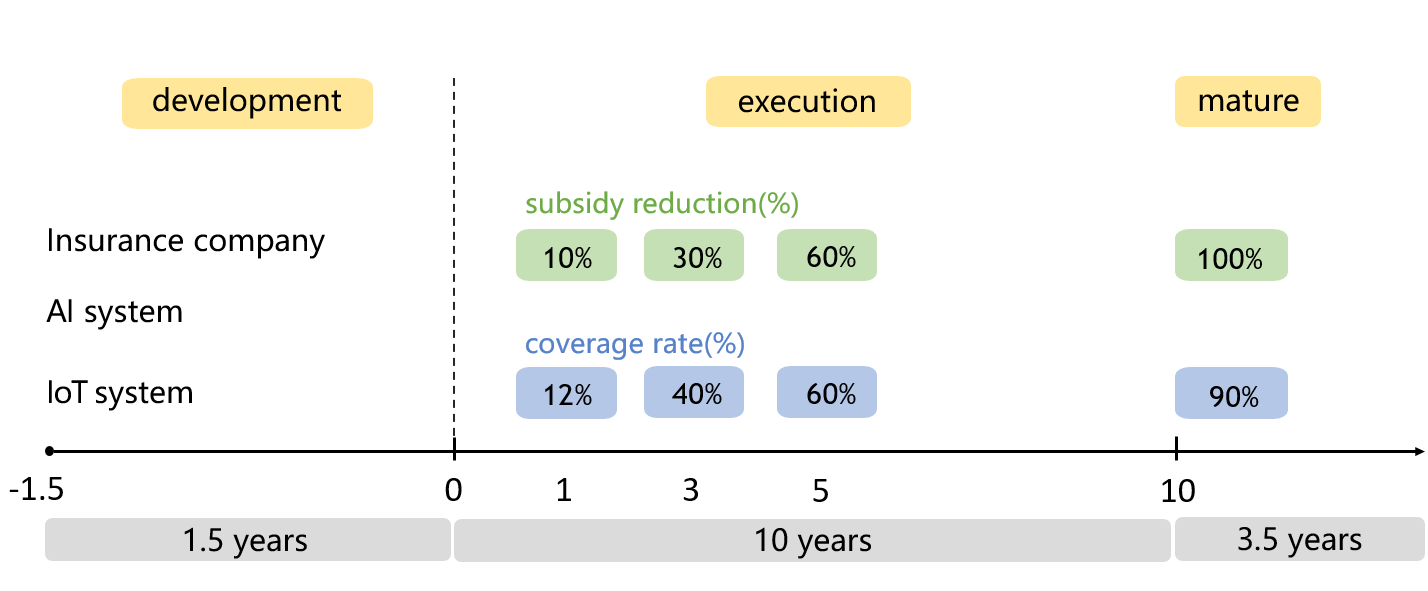

15 Years, No New Budget

We calculated the expected payoff and expected duration, including building the AIoT system and promoting the semi-compulsory insurance policy, if the government were to kick off this project.

As shown above, the promotion was expected to be able to be done in 15 years, and when the system becomes mature, it requires nothing but the current budget. In fact, compared to the government’s current expenses for crop losses (including emergency aid and supplementary budget,) this system actually saves more.

A Self-sustainable Agricultural Insurance System

Overall, our system is designed to cover as many farmers as possible, with affordable insurance programs for both farmers and the government. With customized insurance polices and universal coverage, this insurance system should break-even, and able to reduce total crop losses.

Stakeholders

Consider all stakeholders’ needs (fulfill needs from both farmers and the government)

Customized Aid

Tailor aid approaches and packages to get every penny’s worth

Root Cause

Deal with the root cause (reducing crop losses) instead of the symptoms on the surface (insurance settlements)

Technology Integration

Integrate AI and IoT into the central system, assist farmers in the smart agricultural transformation process

Duration

2018/11 – 2019/01

Instructor

Dr. Chun-I Chiang

Team Leader

Hsin-Ming Chao

Team Members

Jou-Yen Lin, Tzu-Chi Chien, Liang-Chi Liu, Wan-Ting Tsai

With this project, we won second place in the 1st InnoConnect+ Service Innovation Competition, a nationwide competition hold by Service Science Society of Taiwan.

# Personal contribution: team lead, persona, overall structure, system design (AI-based system, semi-compulsory insurance, trust system), UIs