Gamification Finance App

Combining Necessity and Fascination to Attract Younger Generation

An insurance company would like to expand its reach toward younger clientele, but the younger generation not only seldom buy insurance policies, but also lack knowledge and interest in insurance.

“I have no extra money for insurance.”

We realized the real reason why young people are indifferent to insurance is that, they believe they are not wealthy enough to afford any insurance premiums, even before taking a look at insurance policies (which are actually totally affordable).

We analyzed 13 in-depth interviews and 288 questionnaires to gain insight into this project.

“I think I should save up more.”

Moreover, because of their dissatisfying financial situation, the younger generation see “saving money” as of the utmost importance — they do not make much money, do not have a clear financial goal (since setting a goal too large is unrealistic, while setting a goal too small is unnecessary), but want to save money, as well as to make money from small investments.

Thus, we decided to create an application which could not only help young people save up, but provide the fun and socialization they need — this would be what they need and want at the same time!

A Gamification Bookkeeping Application!

Here is our gamification bookkeeping application, where all users can interact with each other and save up together, while the developers can collect data to target precise push notifications on the insurance policies they provide.

With bookkeeping and visualized saving goals, users can systemically save up for their dreams; they can also enjoy our cat-raising simulation game where they feed and play with their virtual cats, as well as engage in social community with other users. Besides, animated videos with insurance information give users a chance to obtain in-game coins, while allowing the company to promote their insurance policies.

Bookkeeping: Save Up for Your Dreams

Users can set up saving targets with a daily/monthly budget. While tracking spending, the amount they save under their budget goes under the “saved amount” category. Once users hit goals, the targets appear on the main screen – visualizing the targets fuels the users’ determination to save more.

Visualize saving goals and gamify the process to encourage users to meet their saving goals

Starting from realistic saving targets, which fits the TA profile

Simulated Cat Game: Keep Users Engaging

Here, users interact with their cats, feed them and change skins for them, with missions appearing randomly from time to time — users can buy insurance policies for their cats before missions, and complete missions to unlock specific pictures and stories.

Users can obtain in-game “meow coins” from actions like tracking daily expenses and watching insurance videos. Additionally, the cats interact with the saving targets on the main screen as well!

Enjoyable, take up little time yet encourage engagement with the app

Collect instances of user behavior to label them

Animated Videos: Promote Knowledge on Insurance

Watching informational animated videos about insurance or money management accumulates in-game “meow coins”; the cats in the game promote related information according to specific user behavior as well (e.g. if users record traveling expenses, the cats would recommend appropriate travel insurance policies.)

Encourage young people to take the initiative and learn about insurance knowledge in a fun way while promoting insurance services

Social Engagement: Fulfill Social Connections

Through the app, users can friend each other, send presents, and their cats can complete missions together. Users can also share their in-game screenshots to other social media platforms.

Fulfill social connections for users – attract new users, increasing overall user number and activities

Substantial Needs

Trigger active participation by “saving money”

Enjoyable Gameplay

Establish continuity and loyalty from users

Sales Integration

Soft sell insurance policies & collect user behavior

Social Connection

Increase user activities & attract new users

What Test Subjects Said…

We asked 11 users to test for our hi-fi prototype, and got some suggestions for user experience optimization, including enlarging fonts and adding description to the icons, as well as several new functions to add, such as a warning notification (when users are almost out of budget), an expense tracking reminder, and a remaining budget display.

“I never thought I could raise a virtual pet by bookkeeping….I think it’s pretty cool.”

— Mr. Lee

“With the visualized targets and the progress bar, I think I would get motivated more.”

— Ms. Wu

“I really love the game and the friend-sharing part. Others (other bookkeeping apps) don’t form that bond.”

— Mr. Huang

“Of course I accept the ads…a lot of apps do that too. I think it’s fine. I can also get some insurance knowledge!”

— Ms. Su

The brief profile of test subjects

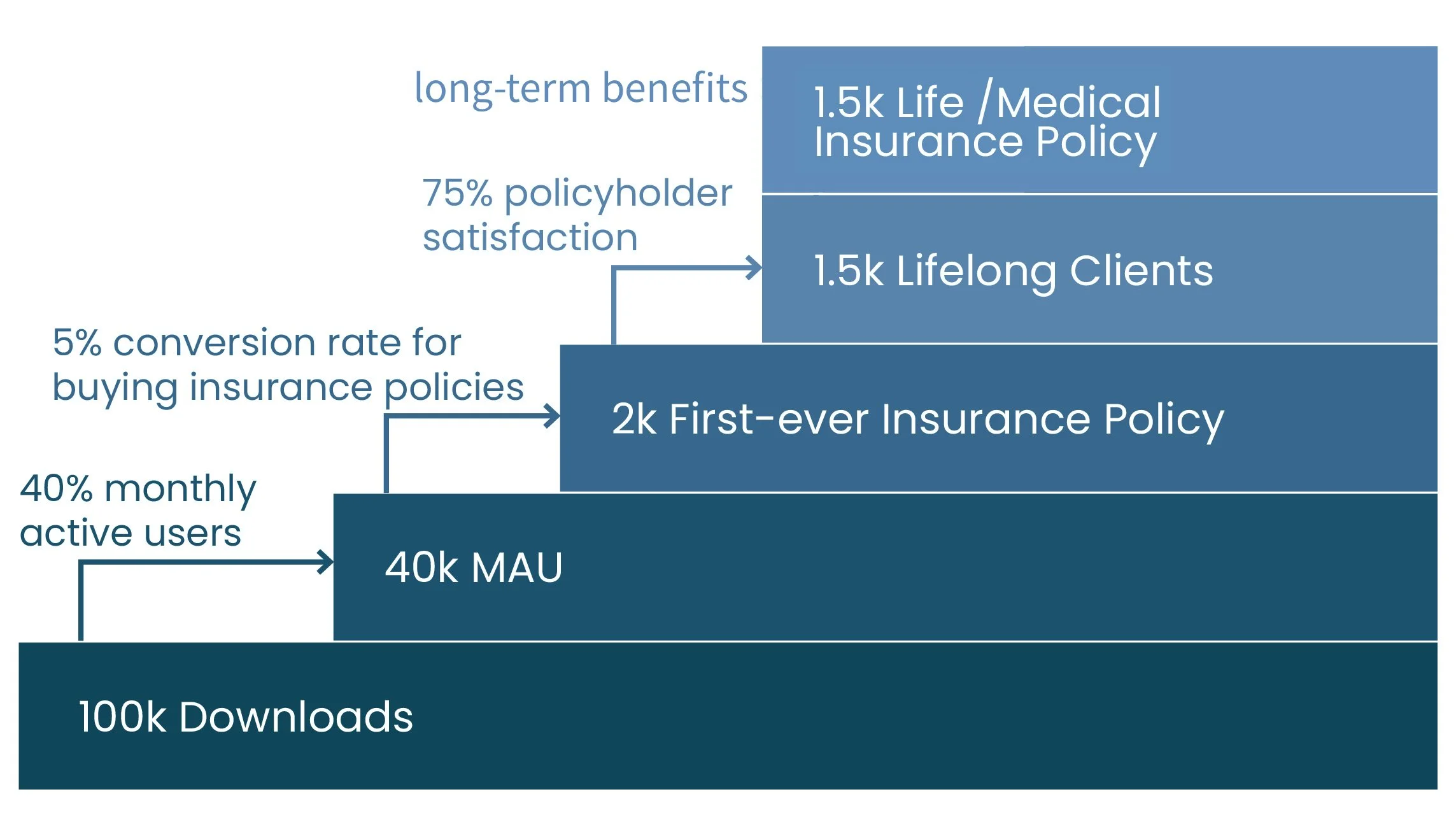

1,500 Lifelong Clients

We also made action plans for developing, marketing and maintaining the application for the insurance company. The project, including 30 weeks for developing the application, 52 weeks for promoting and maintaining it, was expected to be completed in 5.9 million NTD, with 2,000 new insurance clients and 1,500 lifelong ones as returnees.

Duration

2019/03 – 2019/05

Instructor

Dr. Chien-Liang Kuo

Team Leader

Hsin-Ming Chao

Team Members

Jou-Yen Lin, Chien-Yu Yeh, Yi-Ling Lo

Assistants of this project

Yueh-Ting Ling (UI refinement), Wan-Ting Hsieh (illustration), Po-Sheng Wu (animation)

With this project, we ranked top 10 out of 255 groups in the 17th ATCC Case Competition, the largest business case competition in Taiwan. This application was designed for our corporate sponsor, TransGlobe Life Insurance Inc.

# Personal contribution: team lead, user research, app sitemap & user flows, UI wireframes, prototype testing, usability & function optimization