Tea Company: Business Transformation Plan

TA Identification and Brand Repositioning

Taiwan Blue Magpie Tea — a social enterprise whose mission is to encourage local tea farmers to convert to organic farming, allowing the surrounding water sources to rest and purify — reached its break-even point in its third year, but there was no profit growth in the following year. Moreover, as a tea company, Taiwan Blue Magpie Tea’s tea product sales account for less than a quarter of its total revenue.

Thus, I analyzed previous orders, conducted six user interviews and several surveys to find out the underlying issues and develop strategies for them. Here is what I found.

Tea: Water with Flavor

Taiwan is an island with flourishing tea industry. When we look at the whole market, we can see some common traits among the consumers: they often replace water with tea, seeing tea as “water with flavor”; they believe that tea is the healthier choice out of all the drinks; they prefer Taiwanese tea (to varying extents) — those traits showed that tea consumers in Taiwan generally see tea as a daily commodity, instead of rare goods, and they highly value “health” and “domestic products”.

Different Extent of Involvement, Different Behaviour

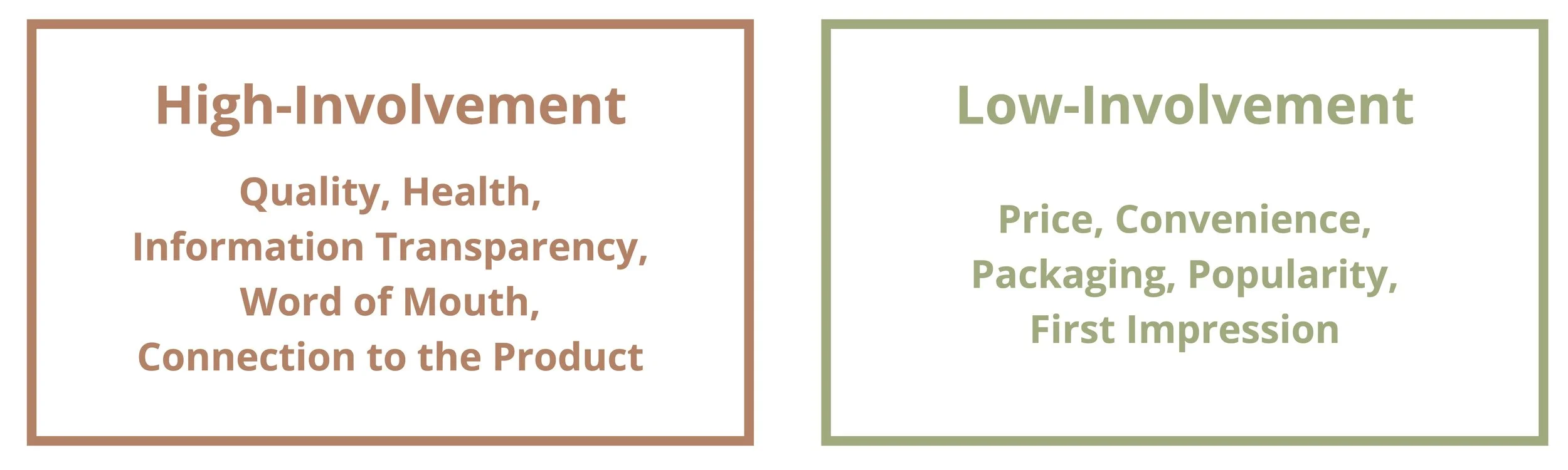

However, of course, not every Taiwanese drinks tea in the same way. If we divide tea consumers with their extent of involvement, we can get two significantly different groups.

High-involvement consumers see tea as a representation of their attitude towards life, thus they care about the quality of tea, tea-tasting opportunity, product traceability, and accept a wider price range. Meanwhile, low-involvement consumers drink tea only out of habit, and hence value a lower price and convenience.

High Product Concentration, Low Repurchase Intent

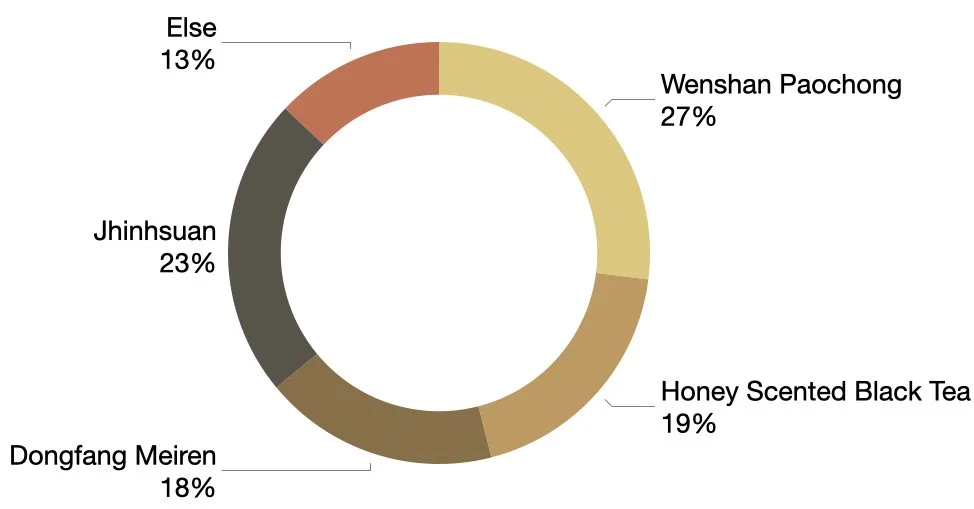

Based on 300+ online orders in the past 2 years

Let’s go back to the customer base of Taiwan Blue Magpie Tea. As the pie shows, its product sales were concentrated: even if the company had 8 varieties of tea, 4 of them accounted for over 80% of the total orders and revenue. Besides, they had a low repurchase rate (under 15%) and a long repurchase cycle (above 6 months).

Frequent Customers Are Not Loyal Customers

Profile of Taiwan Blue Magpie Tea’s frequent customers, based on 6 interviews

What’s more, not even their frequent customers are familiar with the company’s mission (to allow water sources time for recovery) — they do not know the concept of “eco-friendly”, have good tea-tasting abilities, or really have customer loyalty to this brand. Actually, Taiwan Blue Magpie Tea’s frequent customers mostly belonged to the low-involvement consumer group.

Issues: Poor Positioning

Comparing the tea consumer profile in Taiwan with Taiwan Blue Magpie Tea’s current business, it was reasonable to infer the main reason behind the company’s problems was its brand positioning. Here is a brief of my conclusion.

Poor Brand Positioning

The brand mission was positioned as “environmental protection”, a concept only high-involvement consumers care about; however, the actual business does not operate in accordance with the TA’s habits.

Brand Recognition Disparities

Low repurchase rate – the main reason for repurchasing is “pesticide-free”, a poor translation of the brand’s actual mission.

Too Niche of A Market

Environmentalists play a tiny role in the tea brewing market, and the brand mission does not inspire repurchases.

Concentration of sales

Only 4 out of 8 varieties are doing well.

Strategies: Brand Image Adjusting

To solve the problems above, I came up with several possible strategies, and made a transformation plan for Taiwan Blue Magpie Tea.

Redefine TA and Refine Brand Image

Focus on “high-involvement” tea consumers with “strong health consciousness”

Emphasize health, nature, and Made In Taiwan, instead of environmental protection

Increase physical sales channels, including pop-up stores

Obtain certifications for organic farming

Come up with a brand story focusing on places of origin and product background

Reduce Product Line

Only the 5 varieties of tea with better sales remain

Discontinue tea varieties that have a lower revenue

Business Transformation – Flowchart and Project Schedule

2018/12 – 2019/01

I conducted this project when I worked at Taiwan Blue Magpie Tea as a Product Strategist, and it was for company use only.